is there real estate tax in florida

Rental lease or license of. The average Florida homeowner pays 1752 each year in real property taxes although that amount varies between counties.

Tax Portability Transfering Your Tax Benefits From Your Old Homestead To Your New One

Counties in Florida collect an average of 097 of a propertys assesed fair market value as property tax per year.

. Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. The Portability Amendment literally made that tax savings portable so you can now transfer up to 500000 of your accrued Save Our Homes benefit to your new home. Visit Our Website Today Get Records Fast.

Floridas average real property tax rate is 098 which is slightly lower than the US. However the personal representative of an estate may still need to complete certain forms to remove the automatic. Available to all residents and amounting to a maximum of 50000 off the assessed value of the property.

Floridas general state sales tax rate is 6 with the following exceptions. Property owners who want to appeal their property value to the value adjustment board must file a petition one of the DR-486 forms with the clerk of the court. This equates to 1 in taxes for every 1000 in home value.

Its called the 2 out of 5 year rule. The average property tax rate in Florida is 083. Ad Find All The Records You Need In One Place.

Currently there is no estate tax in Florida. Learn all about Florida real estate tax. History of the Florida Estate Tax.

For example the Save Our Homes assessment limitation caps increases in assessments for property taxes at 3 annually. Heres an example of how much capital gains tax you might pay if you owned the house for more or less than 12 months. As a result of recent tax law changes only those who die in 2019 with estates equal to or greater than 114 million must pay the federal estate tax.

The average Florida homeowner pays 1752 each year in real property taxes although that amount varies between counties. The Florida real estate homestead tax exemption is by far the most popular and common way to reduce your property tax bill. The federal government ended up.

Visit Our Website Today To Find In-Depth Tax Records Quick and Easy. Each county sets its. Overall there are three stages to real estate taxation.

Whether you are already a resident or just considering moving to Florida to live or invest in real estate estimate local property tax rates and learn how real estate tax works. Amusement machine receipts - 4. Also the other potential discounts.

There are some laws that limit the taxes due on owner-occupied homes in Florida. What Is The Florida Property Tax Rate. Florida is ranked number twenty three out of the fifty states in.

If the estate includes a business either the executor or business manager if there. It lets you exclude capital gains up to 250000 up to 500000 if filing jointly. Which is the act of placing a value on a piece of real estate.

According to section 193155 FS property appraisers must assess homestead property at just value as of January 1 of each tax year. The property appraiser mails the Notice of Proposed Property Taxes Truth in Millage or TRIM notice. In the year after the property receives the homestead exemption or 1995 whichever is later the property appraiser reassesses the property annually.

You sell your current Florida Homestead that has an Assessed Value of 200000. If youre a Florida. Available in certain cities and counties only this exemption offers up to a 50000 reduction in property value.

If they owned property in another state that state might have a different deadline. What is the Florida property tax or real estate tax. Florida property owners have to pay property taxes each year based on the value of their property.

The state abolished its estate tax in 2004. Property taxes apply to both homes and businesses. Prior to the change in 2004 federal law allowed a credit for death taxes at the state level but on the federal tax return.

This property tax exemption is not limited to the elderly or disabled but its worth mentioning in this article due to its importance. If youre putting together your Florida estate plan its wise to consider whether youll need to pay a federal estate tax. Florida real property tax rates are implemented in millage rates which is 110 of a percent.

In Florida either the decedent or the estate needs to pay the property tax bill issued in the fall by March 31st. The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. Since Floridas estate tax was based solely on the federal credit estate tax was no longer due on estates of decedents that died on or after January 1 2005.

Retail sales of new mobile homes - 3.

2019 Florida Property Tax Appeal Deadlines Are Approaching Firstpointe Advisors Llc

Property Taxes By State 2016 Eye On Housing

Are There Any States With No Property Tax In 2022 Free Investor Guide

Florida Property Tax Calculator Smartasset

Why The House S Proposed Tax Plan Could Set Off The Next Real Estate Recession In Florida South Florida Law Blog

2020 Florida Property Tax Appeal Deadlines Are Approaching Firstpointe Advisors Llc

Your Property Tax Bill Forward Pinellas

The Tax Rate On A 2 Million Home In Each U S State Mansion Global

Southwest Florida Real Estate Taxes Southwest Fl Dave Sage Brenda Boss Sagerealtor Com

How To Lower Your Property Taxes If You Bought A Home In Florida

Florida Property Tax Guide For Homeowners Businesses

Covid Means Tight Budget For Miami Dade Mayor No Tax Hike Miami Herald

A Guide To Your Property Tax Bill Alachua County Tax Collector

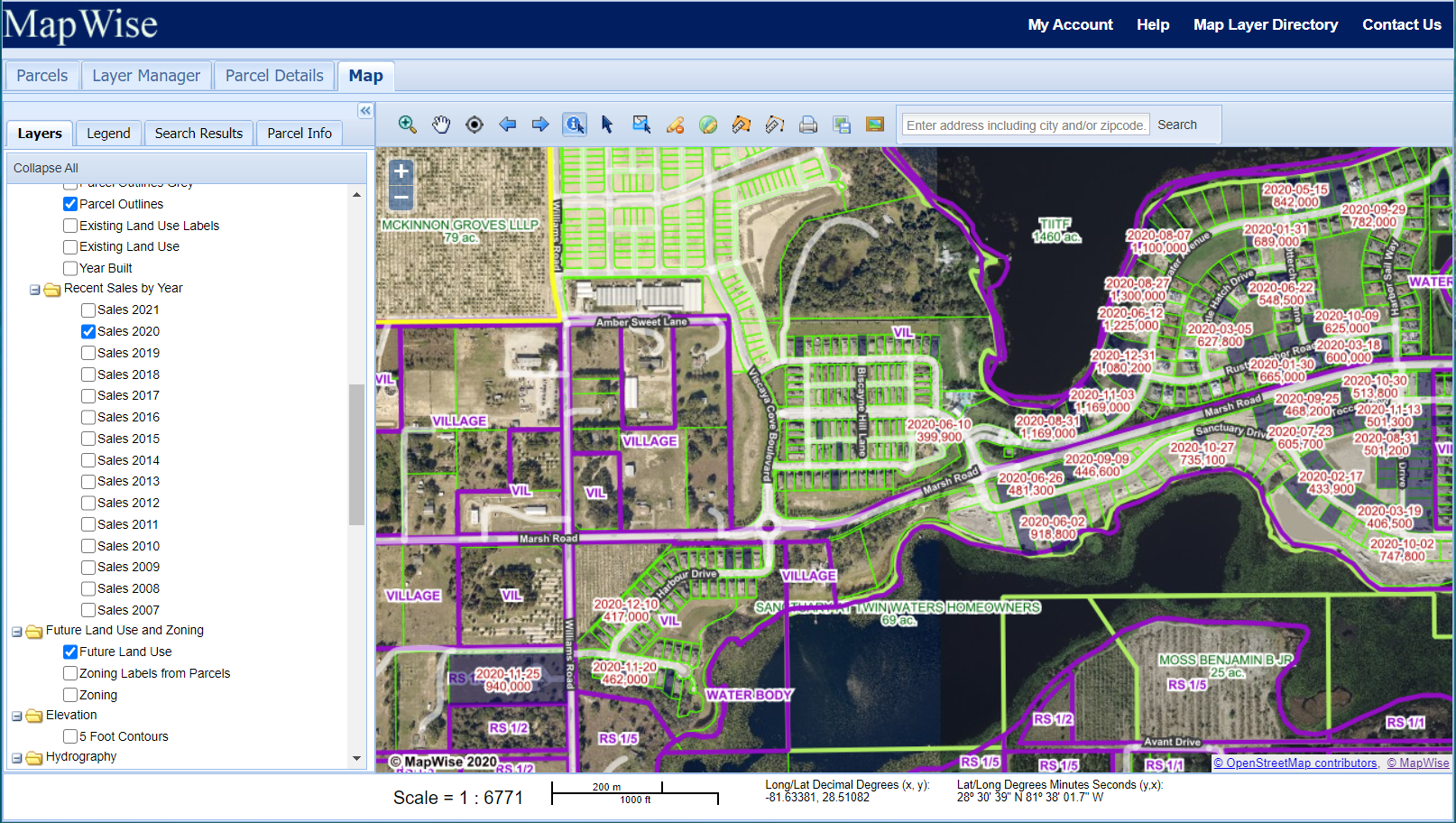

Florida County Property Appraiser Search Parcel Maps And Data

2022 Real Estate Tax Conference Tax Section Of The Florida Bar

Florida Property Tax Consulting Firm Property Tax Consulant

Sales And Use Tax On Commercial Property Rental Florida Sales