tax reduction strategies for high income earners australia

Specifically important numbers for 2022 include. The age for Required Minimum Distributions or RMDs was raised to 72 from 70-½ in 2020 although if you turned 70-½ in 2019 you still needed to start RMDs in 2020.

What Is The Best Tax Software 2022 Winners

As a refresher for 2021 fy the individual tax rates including medicare levy are.

/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

. Take advantage of vehicles for future tax-free income. I Have Dug Deeper Into Ways Middle To Upper Income Tax Payers May Reduce Tax Income Tax. With the budget announcement of a temporary 2 budget repair levy for taxable incomes above 180000 those who will be affected may wish to consider some planning strategies to lessen the impact.

With the Medicare levy already legislated to increase from 15 to 2 from 1 July 2014 the rise in levies will effectively be 25 for. The SECURE ACT includes several key changes that affect tax reduction strategies for high-income earners. Here are some of the most accessible tax reduction strategies that ATO allows.

But you cannot deduct more than 60 of your adjusted gross income AGI. The ATO is far more likely to. In Australia the tax laws make it so that the highest earners of the country are taxed at unbelievably high rates.

Specifically contribute to a traditional 401 k or IRA. Investing in lower income earning spouses name may be better. Max Out Your Retirement Account.

If you are a high-income earner who is planning to sell your primary residence then you may further save on your tax on up to 500k of your capital gains. Charitable donations are an excellent way for you to reduce your income tax liability. Salary sacrificing into super involves forgoing some of your pre-tax salarywages and putting it into super instead.

Exploring tax savings through depreciation superannuation SMSFs and capital gains tax reductions are just. Take Home Rates for an annual income of 400000. Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account.

The higher your tax bracket the higher the benefits are of tax savings. TAX REDUCTION STRATEGIES FOR HIGH-INCOME EARNERS IN AUSTRALIA. Individuals with a taxable income of between 50k and 250k tax brackets gain the most from this strategy due to the super tax rate 15 versus your marginal tax rate.

There is not an income limit to charitable donation deductions. The first way you can reduce your taxable income and therefore your tax on that income is through additional superannuation contributions. This rate is lower than the lowest marginal tax rate therefore you will save tax by doing it.

One can avail of this benefit provided you are married file a joint tax return and the home is the primary residence. ATO allows individuals to reduce their tax on salary by claiming deductions on work-related expenses that were not reimbursed by the employer. We implore you to always seek the counsel of your tax professional as the final authority on any of our ideas below.

For those trying to learn how to save tax in Australia salary sacrificing is one way to do. Tax reduction strategies. Leverage Home Sales Tax.

Keep Accurate Tax and Financial Records. August 12 2014. Tax reduction strategies for high income earners australia.

These retirement accounts use pre-tax money so you can deduct your contributions from your taxable income. In many cases the tax savings can be tens of thousands even hundreds of thousands of dollars in a very short period of time. Many Australian Tax Videos Are Discuss The Same BORING Strategies.

In most cases here youre trading a current tax benefit in the form of lower taxable income now for a future benefit of tax-free income later. This is a tax-effective strategy because super contributions are taxed at the concessional rate of 15 in Australia. Main residence The main residence capital gains tax concessions are arguably the most valuable tax break in Australia for building personal and family wealth.

You can currently claim up to 25000 as a tax. According to an analysis of countries around the world by Price Waterhouse Cooper Australia is ranked nearly at the top of tax rates for high-income earners. This rate is lower than the personal income tax rate.

One allowable tax deduction that can also be a significant long-term wealth creation strategy is maximising your voluntary superannuation contributions. 15 Easy Ways to Reduce Your Taxable Income in Australia 1. This is a tax-effective strategy because super contributions are taxed at the concessional rate of 15 in Australia.

You pay tax on short-term capital gains at your marginal income tax rate.

14 Tax Tips For The Self Employed Taxact Blog

Tax Minimisation Strategies For High Income Earners

/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

How Do 401 K Tax Deductions Work

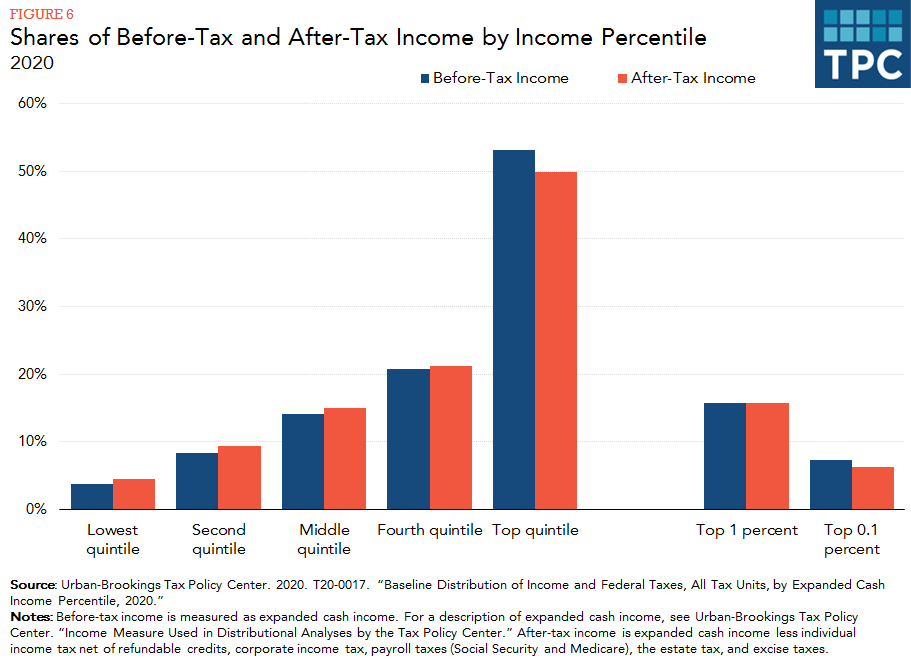

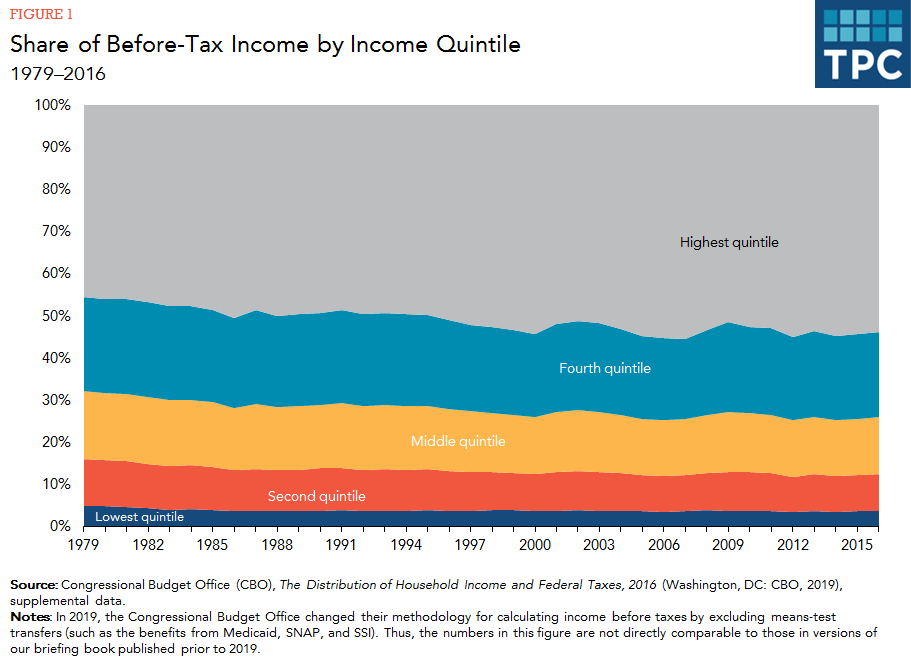

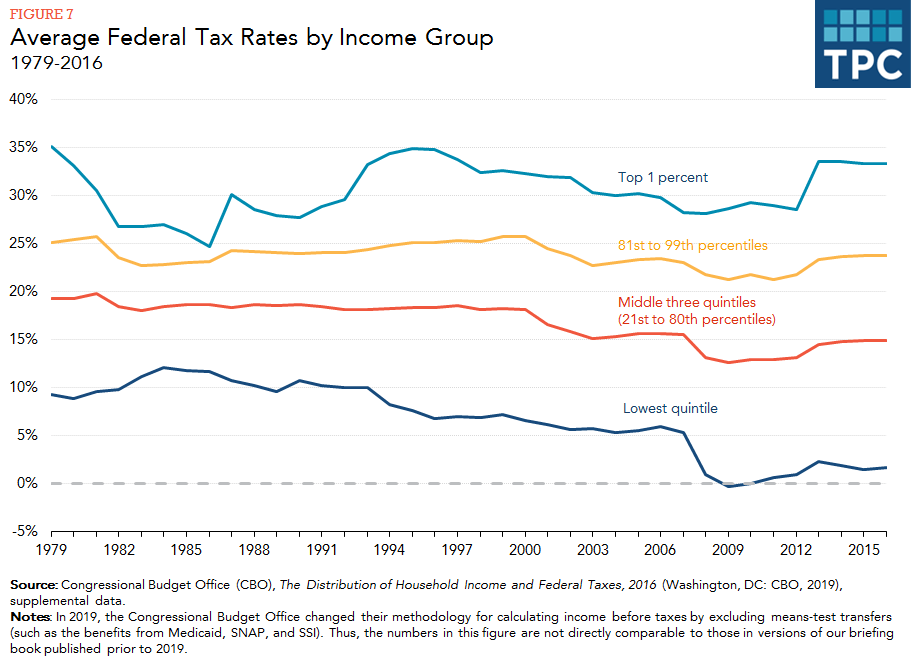

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

Tax Planning For The High Salary Pauper

How Do Taxes Affect Income Inequality Tax Policy Center

:strip_icc()/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

How Do 401 K Tax Deductions Work

How Do Taxes Affect Income Inequality Tax Policy Center

10 Easy Ways To Reduce Tax More Tips From The Etax Experts

Doing Business In The United States Federal Tax Issues Pwc

:max_bytes(150000):strip_icc()/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

How Do 401 K Tax Deductions Work

5 Ways To Reduce Your Tax Australia Youtube

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

10 Surefire Tax Tips For Year End 2021

Some Of Australia S Highest Earners Pay No Tax And It Costs Them A Fortune Greg Jericho The Guardian

Freetaxusa Review Pros Cons And Who Should Use It

How Do Taxes Affect Income Inequality Tax Policy Center

Shipping Container Homes Halifax Shipping Container Homes Container House Plans Container Homes For Sale